Outline:

Since the emergence of advanced woocommerce payment gateway technology, the checkout process has become much simpler, providing a better experience for consumers. However, with a plethora of WooCommerce payment gateways available today, it can be difficult to make the right choice without impeding your sales. You want the payment gateway to meet the needs of both you and your customers.

To make an informed decision, it’s essential to identify their different types, understand their features, and specify their terms. Fortunately, we are here to guide you through the process of selecting and setting up the best one, and we will review some of the most notable examples of excellent payment gateways.

What Is the Payment Gateway

A payment gateway is a service that processes electronic financial transactions. It acts as an intermediary between the buyer and the seller, ensuring that the payment transaction is secure and reliable. Unlike physical cash or credit card retail for brick and mortar shops, payment gateways primarily serve online businesses, including e-commerce websites, online marketplaces, and mobile apps. They authorize transactions made via credit/debit cards or e-Wallets, providing customers with a seamless and convenient payment experience.

There are many payment gateways to choose from in WooCommerce, each with its own set of predetermined options, terms, and fees. However, they all operate using the same principle. It connects your online store with credit card providers and your customers’ banks. When customers purchase a product online, they send their payment information to the service. If the issuing bank approves the charge, the payment amount is deducted from the customer’s account and deposited in the seller’s account. All payment details are protected during the process thanks to the latest encryption technology used in all WooCommerce payment gateways, which ensures that sensitive information such as credit card numbers and personal data are kept safe.

Payment gateways also offer various additional features that can help online businesses streamline their payment processes. For instance, some gateways allow businesses to accept payments in multiple currencies, which can be particularly useful for companies with a global customer base. Other gateways offer fraud detection and prevention services, which can help protect businesses from chargebacks and fraudulent transactions. Additionally, many payment gateways integrate with accounting and financial software, making it easier for businesses to manage their finances and track their transactions.

The Pillars of Online Payment Transaction

While it may seem that having an excellent payment gateway is all you need for seamless electronic transactions, the reality is much more complex. The online payment transaction process involves several components, with a payment gateway being just one of them. In fact, there are typically three parties involved: the customer, the seller, and the technology.

To facilitate online transactions, you need a platform that serves as the base. WordPress is one of the most popular platforms to build modern online stores with seamless payment gateway integration. With the WooCommerce plugin, you don’t need to create your e-commerce website from scratch. It comes with a set of e-commerce functionalities that serve as the technology component.

When a customer presses the “Pay” button on your WordPress e-commerce website, the transaction process begins. The payment details are sent from the customer’s account, and the seller accepts the payment, which is then deposited into a specific type of bank account that admits funds transferred from buyers. The technology acts as an intermediary between the customer and seller, linking the two parties and facilitating the secure transaction itself.

The technology consists of two main components: the payment processor and the payment gateway. Typically, credit or debit card information goes through the first one before proceeding to the payment processor, which finalizes the purchase.

Payment Processors vs. Payment Gateways

Online payment transactions involve two essential components that are often confused: payment processors and payment gateways. Although they are related, they serve distinct functions. Let’s explore them further.

Payment processors are responsible for transmitting payment information from customers’ credit/debit cards to the issuing bank and your business bank account. They handle issues such as credit card limits, card validity, and security. If there is enough money to complete the purchase and the credit card is valid, the payment processor approves the transaction and transfers funds to your business bank account. In other words, payment processors act as intermediaries between customers’ banks and your merchant account, handling personal and financial data.

In addition, payment processors typically charge a fee for each transaction they process. The fee varies depending on the processor and the transaction amount. Some processors also charge a monthly fee or a setup fee. You should research different payment processors to find one that offers competitive rates and meets your business needs.

On the other hand, payment gateways evaluate and process payment data to securely transfer it to the payment processor. All payment gateways use encryption technology to protect personal and payment data. They link your WordPress website with the processing network.

It’s important to choose a payment gateway that integrates with your e-commerce platform or website. Most payment gateways support popular e-commerce platforms like Shopify, WooCommerce, and Magento. Some gateways also offer customization options to match your website’s branding.

To accept payments online, you need both payment processors and payment gateways. Payment gateways ensure that all necessary information is present and secure, while payment processors analyze and transmit payment data, authorizing transactions. By selecting the right payment processor and gateway, you can offer your customers a seamless and secure online shopping experience.

How Online Transactions Are Processed

To understand how an online transaction works, it’s important to know the process involved. Let’s divide it into two phases: authorization and settlement.

Phase #1: Authorization

When a customer buys an item from your WordPress online store using a credit or debit card, their payment information goes through a payment gateway that encrypts it for confidentiality. The payment gateway then sends the encrypted data to the payment processor, which analyzes it along with other concurrent online payment transactions.

The payment processor sends a request to the credit card network to verify the customer’s credit card details, including the card number, expiry date, and CVV code. Once the verification is complete, the card network requests authorization from the customer’s issuing bank to release the funds. The bank approves or denies the transaction based on the availability of funds on the card, as well as other factors like potential fraud or suspicious activity. If the transaction is approved, the online payment transaction is authenticated and authorized.

It’s worth noting that some payment processors offer an additional layer of security called 3D Secure, which requires the customer to enter a one-time password or provide other personal information to authenticate the transaction further. This feature can help prevent fraudulent transactions and reduce chargebacks.

Phase #2: Settlement

After the issuing bank confirms the payment authorization, the card network confirms the validity of the online payment transaction to the payment processor and the payment gateway. The payment gateway then delivers the transaction to the merchant and deducts the funds from the customer’s account. The funds are then deposited into the merchant’s account either immediately or within a few days, depending on the merchant’s account settings.

It’s important to note that merchants may incur fees for each transaction, which can vary depending on the payment processor, the type of card used, and the country where the card was issued. Additionally, some payment processors offer features like chargeback protection or recurring billing, which can be useful for certain businesses. It’s important to consider these factors when choosing a payment processor for your online store.

Types of Payment Gateways

When choosing a WooCommerce payment gateway, it’s essential to find one that fits your business needs. The way businesses manage online payments varies across industries and target audiences. Therefore, it’s crucial to examine different types of payment gateways before making a final decision. There are three main types of payment gateways: iFrame-based, form-based, and direct or integrated payment gateways.

An iFrame-based payment gateway generates a payment form directly on your website through an iframe, but it is an external third-party element that’s managed entirely by the service provider. This can impede your store’s structure, which may discourage customers.

A form-based payment gateway takes customers to an external site to complete the checkout process. It’s more secure than an iFrame-based payment gateway, as credit card security standards are met on a secure third-party site. However, customers may be discouraged by the extra step required to complete their purchase.

Direct or integrated payment gateways are built directly into your website’s structure, ensuring seamless integration and a coherent experience for users. This increases trust during the shopping experience and helps achieve a cleaner, professional outlook. However, this flexibility requires additional security responsibilities, such as having an SSL certificate and adhering to PCI Compliance standards.

In summary, carefully considering the type of payment gateway that suits your business needs is essential. While iFrame-based and form-based payment gateways offer some advantages, direct or integrated payment gateways provide a more seamless and professional shopping experience. Nonetheless, the increased flexibility comes with added security responsibilities.

What to Consider When Choosing a Woocommerce Payment Gateway

While there are plenty of WooCommerce payment plans available, not all of them may be suitable for your online store. Making a hasty decision can harm your business performance. To identify the best solution, you need to consider multiple factors simultaneously:

Compatibility

To choose the best WooCommerce payment gateway, you should ensure that it is compatible with your online store environment. For example, if your store runs on WordPress, you should consider using the WooCommerce payment plugin for better compatibility. This ensures that the payment gateway you select will not hinder your sales but only enhance them. While WooCommerce dominates the e-commerce market, there are several other payment gateways that are still worth considering. Therefore, do not rush to use the WooCommerce payment gateway alone. Since each online store consists of various applications, you might consider some other gateways for better results. Try to take a broad, not one-dimensional view, and identify notable prospects that other solutions may offer.

Usability

Usability is another critical factor to consider when selecting the best payment gateway for WooCommerce. Thinking about it before employing a particular gateway can save you time and money in the future. First, consider the setup process. Is the payment gateway you chose easy to embed with your website? Does it require any coding on the backend? Or can you simply download a plugin and connect it to your site? If you want to handle everything without WooCommerce payment gateway development, you should consider plugins. Be prepared that advanced configuration setups require more effort and time, and if you have neither, choose a more straightforward solution. You also need to think about your customers. Although online shoppers value security first, they also want an impeccable experience during the checkout process. Is the selected WooCommerce payment gateway user-friendly and customizable so that it fits your WordPress website design? Is it compatible with various devices, including mobile phones? Answering all these questions will enable you to find a solution that satisfies your needs without leaving your customers behind.

Consumers’ Payment Methods

Considering various WooCommerce payment methods for your consumers enables your online store to become user-friendly and highly reliable. Thus, you need to focus on your target audience and explore what payment methods they prefer. While most shoppers may use credit cards to pay for their purchases, others may prefer mobiles and e-Wallets or other electronic payment methods. Make sure you do not leave any of your customers behind. You may use multiple payment gateways to cater to all customer groups or adopt a solution that combines all the options preferred by your target market.

Your Payment Methods

Make sure you consider your WooCommerce payment options the same way you do for your customers. Transactions cannot be technically complete unless the corresponding funds enter your merchant account. If you use several payment gateways, you can launch a gateway that holds funds in an internal account from where you can quickly transfer finance to the selected bank account.

Location Сonstraints

Not every WooCommerce payment gateway processes payments universally from anywhere on the globe. Some gateways only support specific countries, so you cannot use them if you are outside the designated region. Therefore, it is essential to evaluate payment gateways based on the issuing merchants’ locations before making the final decision. This requires analyzing your target market and establishing its respective geo-position. Luckily, WooCommerce provides a country filter in the payment gateway extensions store, which allows you to check whether the desired payment gateway is available in your country.

Currency

Like location, not every payment gateway deals with a particular currency. Some gateways may support a wide range of countries but only process payments in one or two currencies. Thus, focus on your target market location demographics to determine the primary currencies to use. An excellent WooCommerce payment gateway should seamlessly deal with all global currencies without any constraints.

Security Policy

To protect your customers’ personal data and funds, it is essential to ensure that your website is secure, especially in the face of frequent hacker attacks on e-commerce sites. A weak payment gateway can compromise the security of your website, making it vulnerable to falsified transactions, which can damage your business’s performance. It is crucial to choose only reliable payment gateways for WooCommerce, which the digital community trusts, and ensure that your website has an SSL certificate and is covered by the Payment Card Industry Data Security Standard (PCI standard).

Optimization

Customers do not like to wait for a long time to complete their purchases. Therefore, it is important to have a payment gateway that can complete the payment process quickly and easily. To ensure a smooth checkout experience, optimize both your website and payment gateway for speed.

Pricing

Choosing the right payment gateway is a business decision, and it is essential to consider your financial options. While none of the WooCommerce payment gateways are free, some require a one-time plugin purchase, while others charge a signup fee. Other costs to consider include long-term use fees, fees paid per transaction, dispute or rejected transaction fees, etc. Instead of immediately choosing the cheapest solution, take the time to analyze the various costs thoroughly. Remember that some additional costs that you might overlook at first can have a more significant impact on your overall profits than high monthly fees.

Top 15 Best Woocommerce Payment Gateways

Probably all of us have heard and even used PayPal, Google Pay, or Stripe. But only a few know that these are some of the most notable payment gateways. What are the reasons for such a saturation within the digital environment and among consumers? To answer the question, let’s see the top 11 best payment gateways and examine their features.

01 PayPal

PayPal is the undisputed giant when it comes to payment gateways. It has over 200 million loyal users all over the world. It’s easy to implement on an online store as it comes with many different extensions available. With PayPal, you can accept credit and debit cards, as well as money from other users through user balances. In addition, PayPal offers various levels of service for merchants and decent protection for customers.

Features:

- enables customers to make payments with or without accounts on the platform

- processes transactions made from credit cards and user balances

- doesn’t require account information every time when accessing

- uses one-touch checkout

- features excellent designs for both web and mobile display to enhance the shopping experience

- keeps sensitive information protected due to the top-notch security technologies

Pricing:

The PayPal WooCommerce extensions are free to acquire and use. It doesn’t have any monthly or yearly fees. However, it takes charge for each transaction that will cost you 2.9% of the overall charge plus $0.30. If you sell in-person on mobile, PayPal will charge you 2.7% of the transaction amount.

Limitations:

The fees depend on where your business is located and where the money is coming from. It also may hit consumers with high rates when having to convert currencies.

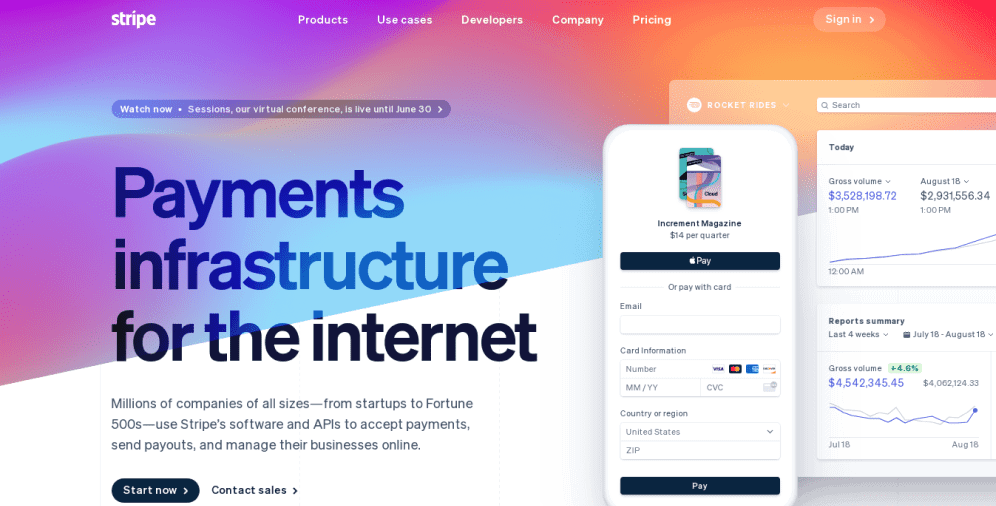

02 Stripe

Stripe is one of the most recognized WooCommerce payment gateways. It is a user-friendly and highly customizable gateway that can be designed according to your website theme. Also, it posts helpful articles and provides 24/7 contact support so that you can get answers to your questions concerning the service.

Features:

- comes with various free extensions

- PCI-compliant

- uses 3D secure, keeping confidential information protected

- highly customizable and flexible to the seller’s website design

- accepts different currencies and local payment methods.

Pricing:

WooCommerce Stripe payment gateway has no subscription fee but carries a 2.9% plus $0.30 per transaction fee for standard services.

Limitations:

Stripe looks at the transaction process through the lenses of programming to ensure a scalable experience. Still, that is not a one-size-fits-all solution. And if you want a fully-ready payment gateway with all pre-built functionalities, you’d better choose another platform.

03 Square

Known for compact credit card technology for mobile phones, Square has evolved, so now it offers both payment software and hardware. It comes with an omnichannel system that handles payments across all your sales platforms, including payments on your WooCommerce store, Android Pay, and Apple Pay payments as well on your mobile.

Features:

- easily gets complemented by other payment gateways

- accepts payments from multiple countries

- uses automatic fraud detection and protection capabilities (in case it fails to prevent the fraud, it provides a chargeback protection)

Pricing:

Transactions made on virtual terminals are charged 3.5% of the transaction value plus $0.15. In-person transactions on mobile or in-store cost 2.75% of the transaction value. Selling through your WooCommerce site will cost you 2.9% of the transaction value plus $0.30. However, there are no penalty fees for chargebacks.

Limitations:

WooCommerce Square payment plan has some significant currency restrictions that might negatively impact international transactions.

04 Authorize.Net

Authorize.Net is a payment gateway that integrates directly on your WooCommerce online store. It’s PCI-compliant and accepts all the major credit as well as debit cards. It is compatible with various service providers, including PayPal payments, eChecks, and eWallets, which makes it easy for the store to process large amounts of various sales and payments. Authroize.Net payment gateway for WooCommerce provides a secure environment that enables the user to save their payment details for the next purchase, which helps to streamline the purchase process.

Features:

- accepts any type of payment options

- supports payments from a wide range of territories

- utilizes a robust fraud detection technology that keeps customers’ personal data secure

Pricing:

It charges a one-time fee of $25 for disputes related to credit card payments. If you want to integrate authorize.net, you need to pay $49 for setup and 2.9% of the transaction value plus a $0.30 transaction fee.

Limitations:

The gateway doesn’t protect you from possible chargebacks. If any – they are usually handled by merchant account providers.

05 Apple Pay

Apple Pay is basically the payment service built for iPhone users compatible with all Apple devices. It allows customers to make purchases not only in online stores but also in brick-and-mortar shops. Apple Pay accepts all major credit cards, debit cards, or anything that is already in the customer’s Apple Wallet.

Features:

- constant customer support

- one-click checkout

- top-notch security

Pricing:

Apple Pay is available on WooCommerce through Stripe. It doesn’t charge any fee when transferring or receiving cash through the delivery. But it charges a 1% fee when the user requests an instant transfer.

Limitations:

Apple Pay is compatible with Apple devices only, which means its users are limited, and not everyone has access.

06 Google Pay

Google Pay keeps the security of its customers as its top priority. Every transaction is encrypted by a specific number instead of the card number, which lessens the risks for fraud. It allows sending money with an email address or phone number with no bank details required. In addition, it employs one-click checkout and contactless payments. It constantly rewards its clients with various cashback offers.

Features:

- compatible with Android, iOS, and web browsers

- accepts payments with a phone number or email address

- one-click checkout

- rewarding programs

Pricing:

Google Pay charges no fee for bank and debit card transactions, but it charges 2.9% per credit card transaction.

Limitations:

Without complete identity verification, you’ll have a lower weekly spending limit and won’t be able to add money to Google Pay balance.

07 WooCommerce Payments

As the name suggests, WooCommerce Payments is a solution developed and offered by WooCommerce. Consequently, it is bound to work seamlessly with any WooCommerce website. It accepts all major credit and debit cards and allows activating recurring payment options and subscriptions.

Since it is a WooCommerce-based payment gateway, all the management of the service is held in WordPress dashboard, from where you can view payments, submit refunds and respond to chargebacks.

Features:

- integrates well with many other WooCommerce extensions

- provides direct access to all payments and settings in the WordPress dashboard

- requires no setup or monthly fee

- simplified payment process that increases the number of users and activity

Pricing:

WooCommerce Payments is free to install and use. The fee is an average of 2.9 plus $0.30 per transaction. It takes an extra 1% for cards issued outside of the United States.

Limitations:

WooCommerce Payments is available for US-based stores only. However, it accepts payments from all over the globe.

08 Amazon Pay

Compared to the gateways described above, Amazon Pay is a relatively new one. Few users know it as a WooCommerce Amazon payment system but not one of the largest online enterprises. And Amazon Pay is the one that best adapts to the use on mobile devices. It employs suitable widgets for both mobile and web and a simple checkout process.

Features:

- accepts multiple currencies

- payments are processed through the Amazon accounts

- user-friendly interface

- easy-to-use

Pricing:

Amazon Pay charges 2.9% and $0.30 per transaction fee.

Limitations:

Despite accepting multiple currencies, it charges 3.9% of the transaction value for international processing.

09 Braintree

Braintree is the PayPal plugin that has an option of recurring subscriptions. Also, it allows saving the payment details for further transfers that significantly improves its usability. It uses credit cards along with e-Wallets such as Android Pay and Apple Pay. The service comes with robust fraud detection that ensures protection during the transaction process.

Features:

- allows saving payment information for future purchases

- processes PayPal, all major credit cards, and digital wallets

- accepts payment from over 45 countries and in over 100 currencies

- pre-built anti-fraud tools

- reporting and recurring billing

Pricing:

There are no monthly fees as well as no per-transaction fee for PayPal. However, it charges 2.9% plus $0.30 per transaction using credit cards and e-Wallets, while An ACH debit costs 0.75% per transaction.

Limitations:

Long account set-up times.

10 Paysafe

Paysafe is another payment gateway supported by WooCommerce that allows customers to pay through credit and debit cards. It also accepts direct debit that means you can make payments right from the customer’s bank account. The power of Paysafe is that it can guarantee the complete privacy of the payment information. It follows PCI compliance that ensures all the card information is sent directly to the Paysafe without going through your servers. Besides, it has excellent customer service with experts ready to help through emails or its hotline service.

Features:

- allows Subscription and Pre-Order payments

- robust security policy

- excellent customer support

Pricing:

Paysafe subscription from WooCommerce charges $79.00 annually. The service follows the sliding scale fee model that is based on a monthly transaction volume. The bigger the volume – the lower the per-transaction price. The pricing starts from 15% down to 9.5% for merchants.

Limitations:

Uses different pricing for selected industries and service providers.

11 2Checkout

2Checkout is an iFramed-based payment gateway that accepts a wide range of payment types, including credit and debit cards, PayPal, international bank transfers, and Payoneer MasterCard. Being available in over 200 markets all around the globe, it offers around 90 currencies as well as multiple languages.

The gateway can be easily integrated with your WooCommerce store, keeping the checkout process within an embedded iFrame that you can customize according to the overall website’s design.

Features:

- processes a wide variety of payment methods

- accepts payment from local as well as international buyers

- accepts payment for both physical and digital products

- multilingual

Pricing:

It is free to install, but just like most payment gateways, it charges 2.9% and $0.30 for each transaction.

Limitations:

Although catering for buyers worldwide, it does charge an extra fee of 1% for international transactions.

12 Trust Payments

Trust Payments is a global payments group that helps businesses to optimize their sales and customer experience through facilitating transaction processes. Its payment gateway connects to numerous international banks, supporting local payments as well. It allows customers to use one payment system for online, in-app, and in-store transactions.

Features:

- uses 3D secure for payment data protection

- one-click payment

- provides dynamic currency conversions

- chargeback management

Pricing:

Trust Payments charges €0.25 + 2.8% per transaction fee and provides volume pricing for enterprises that process over 2,500 transactions monthly.

Limitations:

Primarily caters to European Union customers.

13 Alipay

Alipay is the most-used payment gateway in China. This WooCommerce payment gateway accepts various payments, including PayPal. Also, it allows merchants to perform free test transactions before making the final decision.

Features:

- fully integrated into WooCommerce

- quick and easy setup

- provides free test transactions

- allows consumers to pay via their Alipay accounts

Pricing:

Alipay charges a $0.12 payment fee and a 3% per-transaction fee.

Limitations:

The payment gateway accepts payments mainly within the Chinese market.

14 Skrill

The Skrill payment gateway accepts payments via a variety of payment methods, including e-Wallets, credit and debit cards globally. It also allows consumers to pay with just an email address and password.

Features:

- adhere to high anti-fraud and security standards

- provides chargeback protection

- quick checkout

- allows email transactions

Pricing:

The gateway charges 1% per transaction.

Limitations:

Inactive accounts will have to pay a $3.50 fee monthly, or it will be taken from the account’s fund.

15 Opayo

The Opayo payment gateway accepts online payment via various payment methods with contactless, mobile, and all major card schemes. It offers customisable responsive payment pages that can help you to increase shopper conversion.

Features:

- offers a recurring payment option

- provides various customization options

- fraud screening tools

- single click checkout

- supports more than 25 currencies

Pricing:

Opayo charges a $32.30 fee per month.

Limitations:

Some of the Opayo exclusive features are only available when paid $53.80 monthly.

Ultimately, if you’re still unsure about the best payment gateway for your business, consider the following points to narrow down your choice:

- low and transparent fees

- support for many currencies and locations

- modern checkout interface that processes relevant payment methods like credit cards, e-Wallets

- third-party integrations to WooCommerce and other platforms

- robust security measures, including fraud detection services, PCI Compliance

- additional billing practices, such as recurring billing

- high usability

On a Final Note

Payment processing is a crucial aspect of e-commerce website functionality, and it is essential not to overlook this feature if you want to build a robust digital storefront. Your goal is to provide an excellent customer experience and ensure seamless transactions for your business. To achieve this, you need a reliable payment gateway. There are several payment gateways available, but the default settings of each may not be suitable for your online store environment.

To address this issue, you can integrate multiple payment gateways and allow your customers to choose the option that best suits their needs. This approach not only improves sales performance but also increases consumer trust. With this information, you can select the most suitable payment gateway for your business needs, and it will serve as a reliable assistant for both you and your consumers.

If you have any further questions about this complex topic, please do not hesitate to contact us.